Investor rights in the expired North American Free Trade Agreement continue to undermine democratic decision-making and climate policy in Mexico, Canada, and the United States.

Download as pdf here.

Summary

International investment treaties and investor-state dispute settlement (ISDS) play increasingly prominent roles in debates about the climate crisis and government efforts to mitigate greenhouse gas emissions. Around the world, states and international governance bodies are warming to the understanding that investment treaties threaten progress on decarbonization, sustainable development, and the achievement of human rights. Even in places where countries have taken steps to roll back ISDS, as in North America with the passage of the US-Mexico-Canada Agreement (USCMA), corporate lawsuits against democratically enacted energy and climate policies continue to put a chill on government action.

This report looks at three such cases launched in the past two years against Canada, the United States, and Mexico under the expiring ISDS process in the North American Free Trade Agreement (NAFTA). These disparate cases include: TC Energy’s $15 billion challenge to the Biden administration’s cancellation of the Keystone XL tar sands pipeline; a dispute from Koch Industries involving the cancellation of cap-and-trade in the Canadian province of Ontario; and about a half dozen energy- and mining-related ISDS cases from Canadian and US firms against Mexico, of which we will highlight the Finley Resources case.

What unites these ISDS cases, besides their links to energy and climate policy, is that they should not have been possible to begin with. They can only move forward because of a “legacy” provision that temporarily extended NAFTA’s Chapter 11 investment provisions in the replacement USMCA.

As such, these cases—and the Keystone XL dispute in particular—provide a lesson for countries seeking to exit investment treaties and free trade agreements containing ISDS: unless unreasonable sunset periods are rolled back or canceled alongside ISDS, the threat of investment arbitration to climate action will linger.

NAFTA’s ISDS legacy

ISDS is a system of private arbitration available to foreign investors for settling disputes with governments over public policy choices, legal outcomes, and other measures taken by federal and sub-federal host state actors. These ISDS cases are decided by private tribunals managed by undemocratic, supranational institutions such as the International Centre for Settlement of Investment Disputes (ICSID), which is part of the World Bank. While domestic courts may balance corporate and other public interests in disputes related to government actions, ISDS tribunals are under no such obligation. In practice, they offer foreign investors access to a privileged sphere of international law, subservient to corporate profits, in which human rights and environmental law play a lesser role.

The ISDS system grew out of international investment treaties signed by Germany, the United Kingdom, and the United States in the second half of the 20th century to protect private investment in former western colonies. The treaties achieve this by transposing Western private property rights onto countries whose legal systems, and political priorities, may be quite different. In other words, ISDS was an insurance policy for western corporate interests against nationalist or developmentalist policies in newly liberated countries. Countries whose policies interfered with the profit-making plans of foreign investors and firms could be held financially liable by opaque supranational tribunals in the ISDS system.

In the mid-1990s, this neocolonialist legal innovation was incorporated into the North American Free Trade Agreement, in large part to help lock in neoliberal economic reforms in Mexico. NAFTA thereby became the first free trade agreement to incorporate ISDS—and the first to bind two developed countries (Canada and the United States) to its disciplinary logic. Since NAFTA, successive Canadian, US, and Mexican governments have expanded the reach of ISDS further into hundreds of other trade and investment treaties. They did this even as all three countries were being pummeled by corporate NAFTA lawsuits against reasonable, non-discriminatory policy choices.

Recognizing the faults of this system, countries have begun to withdraw from or renegotiate investment treaties to preserve policy space and avoid growing penalties dished out by unaccountable international tribunals rigged for corporations. ISDS cases often result in damages against the state that surpass the ability of medium- and lower-income countries to pay.

In one recent case, an ISDS tribunal ordered the Pakistani government to pay an Australian joint venture involving a Canadian mining company nearly $6 billion in alleged lost profits for denying a permit to construct a gold and copper mine in Baluchistan province. This ruling would force Pakistan to pay out nearly two percent of its GDP to foreign investors for simply denying them the right to a new mine. As a result, Pakistan tried to overturn the case and take a stand against international investment agreements, including by starting to terminate its 23 bilateral investment treaties. However, after President Imran Khan was ousted in 2022, a new Pakistani government relented and issued the permit. In these scenarios, ISDS can also be used as a stick by western investors to bully global south countries into actively harmful policies.

More recently, a US company has sued Honduras for $10.7 billion for canceling the “model cities” program of the previous government. This incredible sum is equal to over a third of Honduras’ yearly public spending and would, if awarded, penalize the country for not granting a corporation a tax haven within which to exploit workers. These deregulated and highly privatized free trade zones are opposed by local communities, human rights groups, and fair trade advocates for their effects on the livelihoods and human rights of millions of citizens and especially Afro-descendant people who live near these zones.

All of these issues alone would be enough to question the ISDS regime. Yet, it gets even worse when it comes to the climate crisis. ISDS creates problems for governments as they begin to seriously lower greenhouse gas emissions and transition away from fossil fuels. In April 2022, the Intergovernmental Panel on Climate Change (IPCC) acknowledged the threat of ISDS in a working group paper, which read: “[I]nternational investment agreements may lead to ‘regulatory chill’, which may lead to countries refraining from or delaying the adoption of mitigation policies, such as phasing out fossil fuels.”

An October 2022 report of the French High Council on Climate similarly noted that the ISDS process in the Energy Charter Treaty (ECT) “has brought about a greater risk of loss of sovereignty for signatory States in developing or implementing their energy and climate policies, resulting in numerous cases and arbitration judgments that conflict with the decisions of domestic and European courts.”

Over the past six months, many European countries have left the ECT due to the frequent use of its ISDS regime by fossil fuel companies to punish governments for environmental protection measures.

The potential liability that the thousands of investment treaties around the world create for climate action is estimated to be as high as $340 billion. This figure does not even account for ISDS claims that could arise from government efforts to lower emissions from environmentally harmful activities outside the fossil fuel sector, including intensive agriculture and deforestation. In Canada, for example, foreign (mostly US) investors have won ISDS cases related to:

- the regulation of harmful chemicals and toxic waste exports;

- routine bureaucratic and administrative decisions;

- the expansion of private property rights to publicly owned water and timber;

- provincial governments exercising their right to refuse contentious development proposals;

- local economic development requirements on access to publicly owned natural resources; and

- an independent environmental assessment that rejected a quarry proposal based on community values.

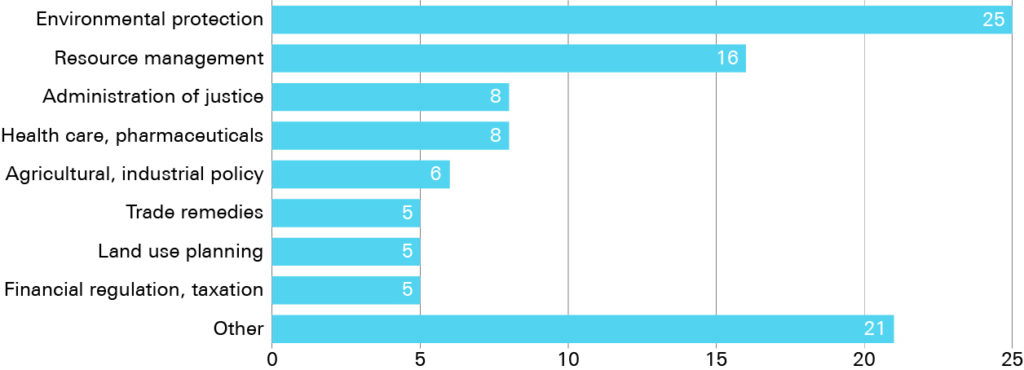

NAFTA Claims by Measure Challenged

NAFTA Claims by Measure Challenged| NAFTA Claims by Measure Challenged, to December 2020 | Number of claims |

| Other | 21 |

| Financial regulation, taxation | 5 |

| Land use planning | 5 |

| Trade remedies | 5 |

| Agricultural, Industrial policy | 6 |

| Health care, pharmaceuticals | 8 |

| Administration of justice | 8 |

| Resource management | 16 |

| Environmental protection | 25 |

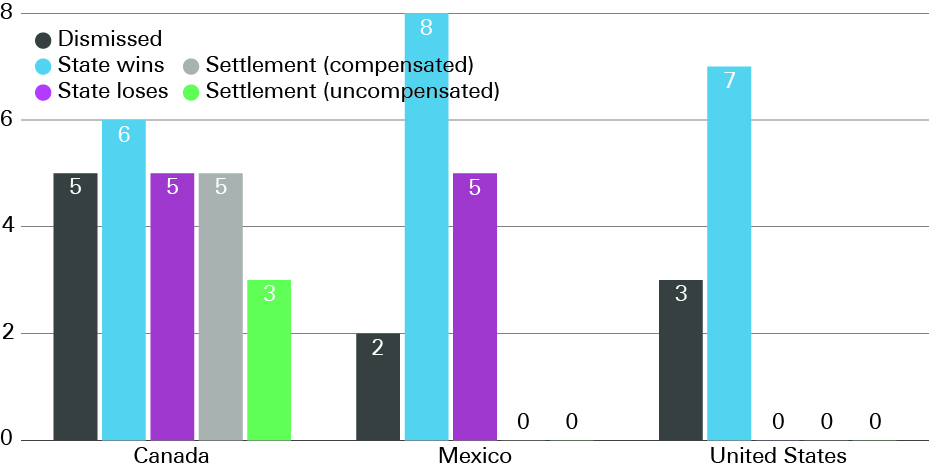

Decided Cases By Country

Decided Cases By Country| Decided cases by country, to December 2020 | Dismissed | State wins | State loses | Settlement (compensated) | Settlement (uncompensated) |

| Canada | 5 | 6 | 5 | 5 | 3 |

| Mexico | 2 | 8 | 5 | 0 | 0 |

| United States | 3 | 7 | 0 | 0 | 0 |

When the USMCA replaced NAFTA in July 2020, ISDS rights were withdrawn for US investors in Canada and Canadian investors in the United States, as negotiated, while Mexico agreed to somewhat more limited investment protections for US firms operating in the country. Under this newly fragmented regulatory space, Canada and the US can legitimately claim to “have strengthened our government’s right to regulate in the public interest, to protect public health and the environment,” as one Canadian official put it. Mexico, on the other hand, remains open to US-based ISDS disputes in many circumstances and the full range of Canadian-based ISDS claims under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The result is a more overtly neocolonial relationship between North and South on the continent—one clearly rigged against Mexico and in favor of multinationals.

Today, most post-NAFTA investment treaties contain a sunset or “zombie” clause whereby investment protections and ISDS persist for 10 to 20 years in the event the treaty is canceled. NAFTA does not have such a clause, so it is strange that all three countries committed to protecting so-called legacy investments for an additional three years (through July 2023) after the agreement expired with the USMCA’s coming into force in July 2020. Article 14-C-1 of the new agreement states: “Each Party consents, with respect to a legacy investment, to the submission of a claim to arbitration in accordance with Section B of Chapter 11 (Investment) of NAFTA 1994.”

Due to the 90-day mandatory cooling off period between filing a notice to bring an ISDS case forward and an official notice of NAFTA arbitration, “legacy” investors have until the end of April to lodge new claims. Last year, law firms offering ISDS-related services to investors, corporations and government ramped up their advertising in articles urging companies to get their NAFTA legacy claims in before the deadline. There are at least eight current claims, but this number could balloon in the coming months, especially in Mexico, where the government is pursuing an activist-developmentalist energy and agricultural policy designed to increase democratic control of the food, fossil fuel, mineral, and electricity markets.

Even at the current legacy caseload, the NAFTA experience with ending the ISDS regime, albeit in a limited way for two of the three countries, should be a lesson for other countries that investment treaty sunset clauses must be dealt with to truly defuse the risk to climate policy.

We will examine three high-profile cases in the US, Canada, and Mexico to show why that is the case. In Mexico, current legacy cases involving tax and land disputes are a further warning about the overreach of ISDS and the financial liabilities it can create for countries looking to crack down on tax avoidance, or secure more equitable resource extraction terms with foreign multinationals.

Legacy case studies

TC Energy Corporation and TransCanada Pipelines Limited v. United States (ICSID Case No. ARB/21/63)

| Tribunal panelists: Eduardo Zuleta, President of the Tribunal Henri C. Álvarez QC, Arbitrator (Canadian) John R. Crook, Arbitrator (U.S.) Claimants’ lawyers: Sidley Austin LLP Notice of intent to file a NAFTA Chapter 11 lawsuit: July 2, 2021 Consultations with Canada per NAFTA Article 1118: September 17, 2021 Request for NAFTA “legacy” arbitration: November 22, 2021 Tribunal formally constituted: September 21, 2022 Alleged NAFTA breaches: Article 1102 (national treatment), Article 1103 (most-favored-nation treatment), Article 1105 (minimum standard of treatment), and Article 1110 (uncompensated expropriation). Compensation sought: $15 billion, plus interest calculated from the date of the breach until the date of payment, and the costs of arbitration including attorneys’ fees and other expenses. |

Opposition to the proposed Keystone XL pipeline, which sought to transport diluted bitumen from Alberta, Canada, across the United States down to the Gulf Coast of Texas, galvanized climate activists, farmers, Indigenous communities and their allies in both countries into protesting against the pipeline. First Nations people in Canada raised alarms about the devastation that would result from increased tar sands extraction, while US Indigenous communities, farmers and environmentalists pointed to the threat of pipeline leaks to the essential Ogallala Aquifer, one of the world’s largest sources of freshwater. The public protests focused attention on the dangers of continued reliance on fossil fuels. Dozens of actions ranging from mass arrests to media outreach led to the eventual withdrawal of construction permits by the US government.

That cancellation should have been the end of the story, but the legal battle continues to this day. The Canadian firms TC Energy Corporation and TransCanada Pipelines Limited filed a “legacy” complaint in December 2021 against the US government under NAFTA’s expiring ISDS provisions. The firms are demanding more than $15 billion in compensation for Keystone’s cancellation, asserting that the revocation of the permit to building the pipeline was unfair and driven by partisan politics rather than environmental policy.

In their November 2021 request for NAFTA arbitration, the firms describe a “drama” that unfolded in three acts. First, the process leading to the November 2015 decision by the Obama administration to deny a construction permit for the Keystone XL pipeline and the firms’ subsequent filing of an ISDS request for arbitration in June 2016. Second, the presidential decree issued by Donald Trump in January 2017 inviting the companies to reapply for a permit, granted in 2019, on condition that they drop the ISDS lawsuit. Finally, the decision by President Biden to once again withdraw approval for the project in January 2021 as part of Executive Order 13990, in which Biden states, “Leaving the Keystone XL pipeline permit in place would not be consistent with my Administration’s economic and climate imperatives.”

TC Energy asserts that environmental reviews showed the pipeline to be safe and that it would not increase greenhouse gas emissions since the same oil would simply reach its destination by other means. That’s a big leap in logic, as the increased availability of oil transportation infrastructure is itself a key driver of new oil production and investment. In addition to the State Department’s findings and evidence submitted by environmental groups of the emissions associated with the project, recent leaks in other TC Energy sponsored pipelines also disprove the supposed safety of the pipeline.

In 2019, just hours after an environmental hearing on the safety of the Keystone XL extension, the existing TC Energy Keystone pipeline spilled 4,515 barrels of oil into rural wetlands in North Dakota. A Government Accountability Office study found that over the last five years, Keystone’s record of oil spills was “worse than the national average.” Sierra Club’s Catherine Collentine commented at the time of the North Dakota spill: “We don’t yet know the extent of the damage from this latest tar sands spill, but what we do know is that this is not the first time this pipeline has spilled toxic tar sands, and it won’t be the last. We’ve always said it’s not a question of whether a pipeline will spill, but when, and once again TC Energy has made our case for us.”

Despite the leaky pipelines, TC Energy claims the decision was unfair. They assert the cancellation violates NAFTA Articles 1102 and 1103 on national treatment and most-favored nation treatment, since other similar US-based pipelines continue to operate, and Article 1110 on expropriations because of the effect on future lost earnings. TC Energy’s ISDS case focuses on the claim that its investments were not given fair and equitable treatment (FET) per NAFTA Article 1105 on the minimum standard of treatment that states must provide to foreign investors.

A general view shows an oil sands mining operation and facility near Fort McKay, Alberta, on September 7, 2022. – At Fort McKay near Fort McMurray in western Canada, in the heart of the country’s boreal forest, the pines and the people were long ago cleared out to make way for huge open-pit mines dedicated to excavation of oil sands. (Photo by Ed JONES / AFP) (Photo by ED JONES/AFP via Getty Images)

A general view shows an oil sands mining operation and facility near Fort McKay, Alberta, on September 7, 2022. – At Fort McKay near Fort McMurray in western Canada, in the heart of the country’s boreal forest, the pines and the people were long ago cleared out to make way for huge open-pit mines dedicated to excavation of oil sands. (Photo by Ed JONES / AFP) (Photo by ED JONES/AFP via Getty Images)FET is a vague standard that has been interpreted broadly by ISDS tribunals to include a requirement that states meet investors’ “legitimate expectations,” including expectations of a stable business environment. Efforts to limit the minimum standard of treatment (MST) in post-NAFTA treaties to clear violations of customary international law have produced inconsistent results during litigation, with tribunals relying on ISDS precedent to allege the evolving and expanding nature of investor protections. NAFTA tribunals, for example, have unevenly applied a 2001 interpretive note, agreed upon by all three countries, aimed at narrowing how tribunals should interpret the minimum standard of treatment definition in Article 1105.”

On the same day that TC Energy and TransCanada filed their first NAFTA ISDS case in 2016, they also filed suit in Texas District Court. In that case, the companies asserted that congressional authority under the Commerce Act should override presidential authority over the national interest involved in the cross-border pipeline. They eventually lost that suit, but the point is that the companies recognized and utilized existing legal mechanisms to make their case in US courts. It is increasingly hard to argue that they also need recourse to supranational protection through ISDS.

Commenting in The Guardian on TC Energy’s earlier 2016 ISDS case, Bill McKibben, the founder of the environmental group 350.org, predicted, “This isn’t going to get the pipeline built…The idea that some trade agreement should force us to overheat the planet’s atmosphere is, quite simply, insane.”

In June 2021, TC Energy formally canceled its plans to build the pipeline, which should have been the end of the saga, yet strangely, it also announced it was moving forward with a new ISDS case. Shortly after, the government of Alberta submitted its own ISDS case for $1.3 billion to recover incentives made through the Alberta Petroleum Marketing Commission (APMC) to support the tar sands extraction and pipeline. The Alberta government announced that investment in March 2020, just months before USMCA replaced NAFTA, and during a US presidential campaign in which Biden and other Democratic candidates indicated their opposition to ISDS. Kyla Tienhaara of Queen’s University points out that the Alberta case is especially dubious, since it potentially leaves “Alberta’s taxpayers worse off considering the high cost of ISDS proceedings.”

The Keystone XL NAFTA case seems to rest on the idea that business as usual is the law of the land, even when rising temperatures, droughts and floods plague those very lands. Contrary to their statements, the pipeline was never on solid ground in terms of the spills and emissions generated by the tar sands. The companies had decades of warnings of the reasons to abandon the project, both based on science and the public imperative to change course to address climate change.

The new lawsuit is a warning of the lasting legacy of legitimizing ISDS in past trade agreements—and the foolishness of continuing those provisions as governments around the world take action to transition to cleaner energy, lower emissions and respect for the heritage of our lands and environments. In January, the Biden administration challenged TC Energy’s right to bring its legacy case forward on the grounds that the USMCA “legacy” clause is reserved for investment disputes related to alleged infractions before NAFTA was replaced in July 2020. While it would be a relief for the tribunal to agree with this view, it’s far from clear it would, since the USMCA is vague on this point.

Finley Resources Inc., MWS Management Inc., and Prize Permanent Holdings, LLC v. United Mexican States (ICSID Case No. ARB/21/25)

| Tribunal panelists: Manuel Conthe (Spain), President of the Tribunal Franz X. Stirnimann Fuentes, Arbitrator (Peruvian, Swiss) Allan Pellet, Arbitrator (French) Claimants’ lawyers: Holland and Knight Request for NAFTA “legacy” arbitration: March 25, 2021 Tribunal formally constituted: October 22, 2021 Alleged NAFTA breaches: Article 1102 (national treatment), Article 1103 (most-favored-nation treatment), and Article 1105 (minimum standard of treatment). Compensation sought: $100 million. |

Of the three NAFTA countries, Mexico was by far the most harmed from the decision to extend NAFTA’s ISDS for an additional three years into the USMCA. The legacy clause of the new deal has become an essential tool in the full assault against Mexican energy sovereignty reforms under the presidency of Andrés Manuel López Obrador (AMLO).

In May 2021, Mexico passed a law that gives increased power to the state to participate in the oil and gas sector, including by enabling the government to intervene in private oil and gas projects in cases of imminent threats to energy security or to the economy. In a reversal of recent policy trajectories favoring foreign private capital, under the new law Mexico’s publicly owned and operated oil and electricity companies are given primacy in the development of Mexico’s energy future.

This was a break with the previous regime where dozens of foreign companies began entering Mexico’s oil and gas sector after President Felipe Calderón’s unpopular energy reforms in 2013. These reforms aimed to break state-owned oil company Pemex’s control over energy by privatizing the power and electricity sectors and opening the country to foreign investors. In those intervening years after Calderón’s reform, more than 100 oil contracts were issued to budding Pemex rivals. As a result, Mexico ended up exporting crude oil cheaply and having to import refined gasoline at higher prices. This absurd situation was why AMLO decided to repair six refineries in Mexico and build a new one (Dos Bocas), and even to buy one in Texas.

These moves aimed at energy sovereignty and maximum benefits for Mexico have been interpreted in the US and Canada merely as an effort to increase fossil fuel production to the detriment of well-meaning private solar and wind producers. “Both (U.S) President (Joe) Biden and I are going to be… fairly clear with President Lopez Obrador that this… needs to be understood as a way to help Mexico develop, a way to continue to draw in investments from companies in Canada and the United States,” said Canadian Prime Minister Trudeau on his way to attend the North American Leaders’ Summit in Mexico City in January.

But as analyst Kurt Harckbarth explains, “all this amounts to a public-relations scam.” Mexico’s efforts to secure its domestic energy situation through nationalization do not preclude an expansion of cleaner types of energy as well, which are well established in the country. Indeed, much of the interest of US and Canadian firms in investing in Mexican energy is also in fossil fuels.

The United States and Canada have both separately requested consultations with Mexico on the energy reforms under USMCA’s state-to-state dispute settlement process in Chapter 31. A loss for Mexico could result in punitive tariffs of between $10 billion and $30 billion.

However, it is unclear whether these cases can move forward given that Mexico achieved recognition in Chapter 8 the USMCA of its “Direct, Inalienable, and Imprescriptible Ownership Of Hydrocarbons.” The agreement clearly states, “In the case of Mexico, and without prejudice to their rights and remedies available under this Agreement, the United States and Canada recognize that: (a) Mexico reserves its sovereign right to reform its Constitution and its domestic legislation.”

| Plaintiff company | Initiated | Nationality of company | Treaty | Sector | Status | Amount Claimed |

| Legacy Vulcan/Calizas Industriales del Carmen (CALICA) | 2018 | U.S. | NAFTA | Mining | Pending | $500M |

| PACC Offshore Holdings Services LTD | 2018 | Singapore | BIT | Oil | Decided in Favor of Investor | $227M (company awarded $6M) |

| Alicia Grace and others | 2018 | U.S. | NAFTA | Oil | Pending | $700M |

| Odyssey Marine Exploration | 2019 | U.S. | NAFTA | Mining | Pending | $3,5B |

| First Majestic Silver Corp. | 2020/21 | Canada | NAFTA/ USMCA legacy | Mining | Pending | $500M |

| Finley Resources and others | 2021 | U.S. | NAFTA/ USMCA legacy | Oil | Pending | $100M |

| Coeur Mining Inc. | 2022 | U.S. | NAFTA/ USMCA legacy | Mining | Pending | $45M |

Sources: International Center for Settlement of Investment Disputes, UNCTAD Investment Policy Hub. The table includes only Oil, gas, mining and energy claims that have proceeded to the request-for-arbitration stage.

Hence, investors, under the advice of big law firms, are taking matters into their own hands.

The main oil and gas lobby group in the United States, the American Petroleum Institute, has sent letters to Mexican and US leaders expressing concern that regulatory and constitutional reforms by the Mexican government discriminate against US investors and violate the USMCA. “These targeted actions against API member companies likely contravene Mexico’s USMCA commitments to accord non-discriminatory treatment with respect to the trade in goods (Article 2.3), investment (Article 14.4), and the sales and purchases of state-owned enterprises and designated monopolies (Article 22.4),” reads a letter dated May 2021. “These actions also appear to violate additional rules related to investment, including the minimum standard of treatment (Article 14.6), and they could also result in unlawful indirect expropriations (Article 14.10).”

Mexico is now fighting several suits related to energy and natural resource reforms during the early USMCA period. One, filed on May 12, 2021, comes from a group of US oil and gas firms including Finley Resources Inc., which won two oil tenders and negotiated a third drilling service contract with Mexico’s state-run firm Pemex. Finley et al. argue that Mexico violated their investor protections under NAFTA by failing to honor certain contractual agreements and allegedly favoring domestic firms since AMLO pledged to regain energy resources reviving Pemex and the state-owned utility Comisión Federal de Electricidad (CFE).

Finley Resources lawyer said that “Mexico promised that Finley’s investments would be protected,” and that instead, the country’s courts provided “little to no movement” on the dispute while Mexican oil service companies that made similar claims received more favorable treatment. To Finley, Pemex failed to pay for services provided by the companies, while other contracts were not honored by Mexico.

The ISDS news site Investment Arbitration Reporter reported that the Finley case “appears to be the second claimant invoking this legacy provision in a claim against Mexico, after the Canadian miner First Majestic Silver, whose ICSID claim against Mexico was lodged earlier this year.”

First Majestic is demanding $500 million in compensation for Mexican tax reforms aimed at recuperating lost taxes in the mining sector due to alleged tax evasion. “All too often, foreign mining companies use legal loopholes or manipulate mineral production data to pay less tax to the Mexican tax authorities, or they demand the reimbursement of the deductible part of the tax amount,” explains María Teresa Gutiérrez-Haces, senior researcher at the Institute of Economics Research of the Universidad Nacional Autónoma de México, in a recent article. “Such is the case of First Majestic Silver, which Mexican tax authorities accuse of altering the prices of silver extraction since 2002, thereby evading full taxes.” In November 2022, US firm Coeur Mining launched a similar legacy claim against Mexico to dispute these tax recovery measures.

It seems likely that other spurious cases could arise as the April 2023 deadline for filing legacy cases nears. Last November, the Michigan-based Access Business Group (ABG) filed a notice of intent to submit a NAFTA legacy claim against Mexico in relation to a dispute over a large industrial venture. The private firm, owner of Amway-Nutrilite, is demanding a staggering $3 billion in compensation for the alleged expropriation of land on which its business depends. The land was returned to local community members after a decades-long campaign to reassert their legal title. This return was supported by the Mexican government, which has been fulfilling a decree of President Lázaro Cardenas since 1939 to return common lands (ejidos) to peasants and rural workers. This last suit is remarkable both for the size of the potential award but also as a rare case involving public lands.

Due to the extension of ISDS for three years after the replacement of NAFTA by the USMCA, Mexico’s energy sovereignty, entrenched in Chapter 8 of the USMCA, will continue to be subjugated by the investment protection clauses of NAFTA. The Mexican experience is a clear warning to other lower-income and developing countries who are looking to exit ISDS treaties that the sunset clauses in these treaties must also be eliminated or otherwise neutralized to avoid needless costs and risks associated with post-treaty ISDS claims.

Koch Industries, Inc. and Koch Supply & Trading v. Canada (ICSID Case No. ARB/20/52)

| Tribunal panelists: Eduardo Zuleta, President of the Tribunal Henri C. Alvarez QC, Arbitrator Andrea K. Bjorklund, Arbitrator Claimants’ lawyers: Steptoe & Johnson Notice of intent to file a NAFTA Chapter 11 lawsuit: February 20, 2020 Consultations with Canada per NAFTA Article 1118: May 2020 Request for NAFTA “legacy” arbitration: December 20, 2020 Tribunal formally constituted: April 27, 2021 Alleged NAFTA breaches: Article 1105 (minimum standard of treatment) and Article 1110 (direct and indirect expropriation) Compensation sought: $31,322,474.62 |

Given Canada’s track record as the most sued North American country under NAFTA’s ISDS process, it was on trend for Canada to become the target of the first USMCA “legacy” case in late 2020. The case pits Koch Industries, a climate-denying fossil fuel trader, against the cancellation of a Canadian environmental measure that modestly increased costs to business as a way of incentivizing lower economy-wide carbon emissions.

In June 2018, a newly elected conservative government in the Canadian province of Ontario, hostile to carbon pricing, made good on a promise to scrap the provincial cap-and-trade program, which had been in place only since January 2017. The move had little popular support and the government was later found to have violated the province’s environmental laws by not consulting the public first before acting. Yet, it went through nonetheless.

As their name suggests, cap-and-trade systems cap and gradually reduce the total allowable carbon emissions each year across industries covered by the system. Companies with emissions above the industry cap must purchase credits, or allowances to continue polluting, while companies with lower carbon emissions are offered credits. These allowances are exchanged on a carbon market, with governments issuing additional allowances throughout the year. The international use of carbon markets is expanding despite their questionable efficacy in lowering overall emissions.

The 2018 post-election Ontario legislation dismantling the program allowed for some of the previous participants to receive compensation for some of their now unusable carbon credits. However, this excluded so-called market participants such as Koch Supplies & Trading (KS&T). As Canada notes in its February 2022 response to Koch’s NAFTA lawsuit, the provincial legislation establishing cap-and-trade clearly states there is no right to compensation for any losses incurred through participation in the program and that there can be no expropriation under Ontario law. This approach mirrors other international cap-and-trade programs.

Nonetheless, prior to launching its NAFTA case, the US corporation pleaded multiple times for compensation, even as it reiterated its opposition to the concept of cap-and-trade in a submission to the Ontario government on the legislation cancelling the program itself. According to Koch’s October 2021 memorial on the merits of its NAFTA case, a director of policy in the Ontario premier’s office told the company that if they wanted their money back, they should sue the federal government under NAFTA. Thus, they did.

In their request for arbitration under the NAFTA “legacy” clause of the USMCA, KS&T and parent company Koch Industries jointly claim that the Ontario government’s cancellation of cap-and-trade resulted in the unlawful expropriation (direct and indirect) of the firms’ investments and violated the minimum standard of treatment guarantee in chapter 11 of NAFTA. The firms are demanding about $31 million in compensation for the alleged value of carbon allowances purchased in the province’s final cap-and-trade auction in May 2018. As is standard, KS&T is also asking the NAFTA tribunal to award interest on that sum and for Canada to pick up the company’s legal fees for bringing the dispute forward.

The Koch NAFTA lawsuit is problematic for a number of reasons. First, it is an example of a foreign company attempting to use ISDS to win rights or privileges not available to domestic firms engaged in similar activities. As Koch notes in its memorial on the merits of the case, while Ontario’s cap-and-trade cancellation law indemnified the province from domestic legal action, “it is not true from the perspective of international law.” The Ontario legislation clearly precluded any opportunity for participants to file expropriation claims in the courts that relate to changes to the cap-and-trade system. The special treatment granted multinationals under ISDS has united opponents of investment arbitration across the political spectrum.

Second, it is not at all clear why the Ontario government should have to compensate Koch for essentially speculative losses. As mentioned above, KS&T acted as a market participant in the Ontario program, purchasing emissions allowances in auctions over the course of 2017 and 2018. These allowances were then resold on the open carbon trading market to companies whose emissions were above Ontario’s annual cap. INVISTA, a Koch subsidiary with chemical manufacturing plants in Maitland and Kingston, Ontario, was one beneficiary of this legal emissions trade, according to Koch’s memorial on the merits.

After Ontario’s system was fully integrated with similar cap-and-trade regimes in California and Quebec in January 2018, Canadian Koch affiliates were able to purchase Ontario carbon allowances for high-emitting California affiliates and vice versa, with KS&T in prime position to facilitate those trades. In fact, as Canada’s counter-memorial points out, buying Ontario credits for its California companies was Koch’s primary aim in participating in the Ontario allowances auctions. Koch was also looking to profit off speculative emissions trading with other, often non-emitting “market participants” in the system.

Third, Koch should have seen the Ontario cap-and-trade cancellation coming, given that polls were indicating an election win for the Conservative Party, which was promising to kill the program. As a hedge, KS&T could have skipped the May 2018 carbon allowance auction altogether. As Canada’s counter-memorial notes, the company also had time between June 11, when the Ontario allowances were deposited into its account, and June 15, when California blocked carbon-trading with Ontario, to shift its new Ontario allowances to California’s carbon market but did not avail itself of the option. What’s more, the amount sought by KS&T in the NAFTA lawsuit is a tiny fraction of Koch’s annual revenues of $115 billion in 2020. The company could easily write off its losses in Ontario, as the many other market and emitting cap-and-trade participants caught up in the cancellation will have to do. All in all, Koch is arguing that there is no business environment where they can fail.

The fourth problematic aspect of the Koch NAFTA legacy case is the company’s claim that its minimum standard of treatment (MST) guarantees in Article 1105 of NAFTA were also violated. “NAFTA tribunals have…recognized that Article 1105(1) encompasses a State’s obligation to ensure regulatory fairness and predictability to investors, which includes the need to avoid sudden and arbitrary modifications of the legal environment of the investment,” says the Koch memorial on merits.

WASHINGTON, DC – NOVEMBER 18: U.S. President Joe Biden (C), Canadian Prime Minister Justin Trudeau (R) and Mexican President Andres Manuel Lopez Obrador (L) walk in the Cross Hall prior to a North American Leaders’ Summit (NALS) at the White House November 18, 2021 in Washington, DC. (Photo by Alex Wong/Getty Images)

WASHINGTON, DC – NOVEMBER 18: U.S. President Joe Biden (C), Canadian Prime Minister Justin Trudeau (R) and Mexican President Andres Manuel Lopez Obrador (L) walk in the Cross Hall prior to a North American Leaders’ Summit (NALS) at the White House November 18, 2021 in Washington, DC. (Photo by Alex Wong/Getty Images)As mentioned above, while the NAFTA parties dispute this interpretation of MST, tribunals have agreed with it in past decisions. Tax measures and environmental policies that treat domestic and international investors exactly the same have been deemed to breach the international investor’s right to have their “legitimate expectations” met under MST and “fair and equitable treatment” clauses under investment treaties. In fact, Spain has been ordered to pay more than 1.2 billion euros (US$1.22 billion) to foreign investors so far after changes to the government’s solar power payments to private energy firms triggered a wave of ISDS cases.

The Ontario government’s cancellation of cap-and-trade was perceived by environmental groups as a step back for climate action or at least for climate financing in the province. Nonetheless, contrary to Koch’s assertions of arbitrariness and abruptness, the decision was advertised in advance and legitimately taken by a government with other public priorities. Governments will need to take similarly decisive, though more effective, public action to phase out fossil fuels and rein in greenhouse gas emissions if we hope to meet our climate obligations. NAFTA’s legacy to the world—the normalization of ISDS in thousands of treaties—was to put a chill on government decision-making while providing regulatory certainty to climate criminals like Koch.

Conclusion and recommendations

This report has highlighted how NAFTA’s expiring investor-state dispute settlement process continues to obstruct national energy and climate policy under the “legacy” provisions of the replacement USMCA. Total claims for compensation under these legacy ISDS cases are pushing $20 billion and we have likely not seen the end, as law firms continue to urge investors to file their notices of intent to launch NAFTA arbitration before the April deadline. The NAFTA experience is clear proof that countries must not only exit treaties containing ISDS but also neuter the sunset clauses in these treaties to reclaim their policy space so that we can quickly and affordably address the climate crisis.

In early November, ahead of the COP27 climate summit in Egypt, each of the author’s organizations endorsed a global statement on ISDS signed by over 380 international organizations. “We must urgently get rid of the ISDS system,” it read. “The evidence of years of damage to the environment, land, health, and self-determination of peoples all around the world is stark, and the renewed urgency of the climate imperative is beyond doubt. Reform proposals are weak, ineffective, and totally inadequate for what is needed. Governments must take immediate action to put an end to the risks of ISDS.”

To conclude, we therefore repeat the demands from international civil society for our countries to move beyond the steps they have already taken away from the ISDS regime by removing it from the USMCA. Practically this would mean that all countries, including the three NAFTA parties, must:

- Stop negotiating, signing or ratifying new agreements that include ISDS, as the Australian government has just committed to doing;

- Stop joining existing agreements that include ISDS, such as the Energy Charter Treaty or Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and remove the ISDS process from these agreements;

- Stop extending existing agreements to include ISDS, such as the Regional Comprehensive Economic Partnership (RCEP) or African Continental Free Trade Area (AfCFTA);

- Terminate or exit existing agreements with ISDS, including all Canadian, Mexican and US free trade agreements and bilateral investment treaties with middle- and lower-income countries;

- Withdraw from, and withhold consent to, the use of ISDS;

- Leave ICSID and promote national and regional options for the resolution of disputes between investors and the state;

- Give primacy in investor-state disputes to the protection of human and environmental rights, natural resources and ecosystems, and basic human needs such as energy, food, public services;

- Explore alternatives to ISDS, including investment risk insurance, international collaboration to strengthen domestic legal systems, and human rights mechanisms; and

- Demand and regulate responsible behavior from transnational companies in areas such as labor, social, and environmental rights consistent with the highest standards between trading partner countries.

About the authors

Stuart Trew is the director of the Trade and Investment Research Project at the Canadian Centre for Policy Alternatives. Manuel Pérez-Rocha is an associate fellow of the Institute for Policy Studies in Washington and an associate of the Transnational Institute in Amsterdam. Karen Hansen-Kuhn is the program director of the Institute for Agriculture and Trade Policy.

Acknowledgments

The authors would like to thank Kyla Tienhaara, Hélionor de Anzizu, and Hadrian Mertins-Kirkwood for their valuable comments on earlier versions of this report. They also thank Aaron Eisenberg and Rosa Luxemburg Stiftung–New York for editing and their support in producing this and past trinational papers and workshops on the links between trade, climate change, environmental policy, worker and human rights, and democracy. Any errors are the fault of the authors alone.

Download as pdf here.

The post NAFTA’s Shadow of Obstruction appeared first on RLS-NYC.

1 year ago

115

1 year ago

115